- This event has passed.

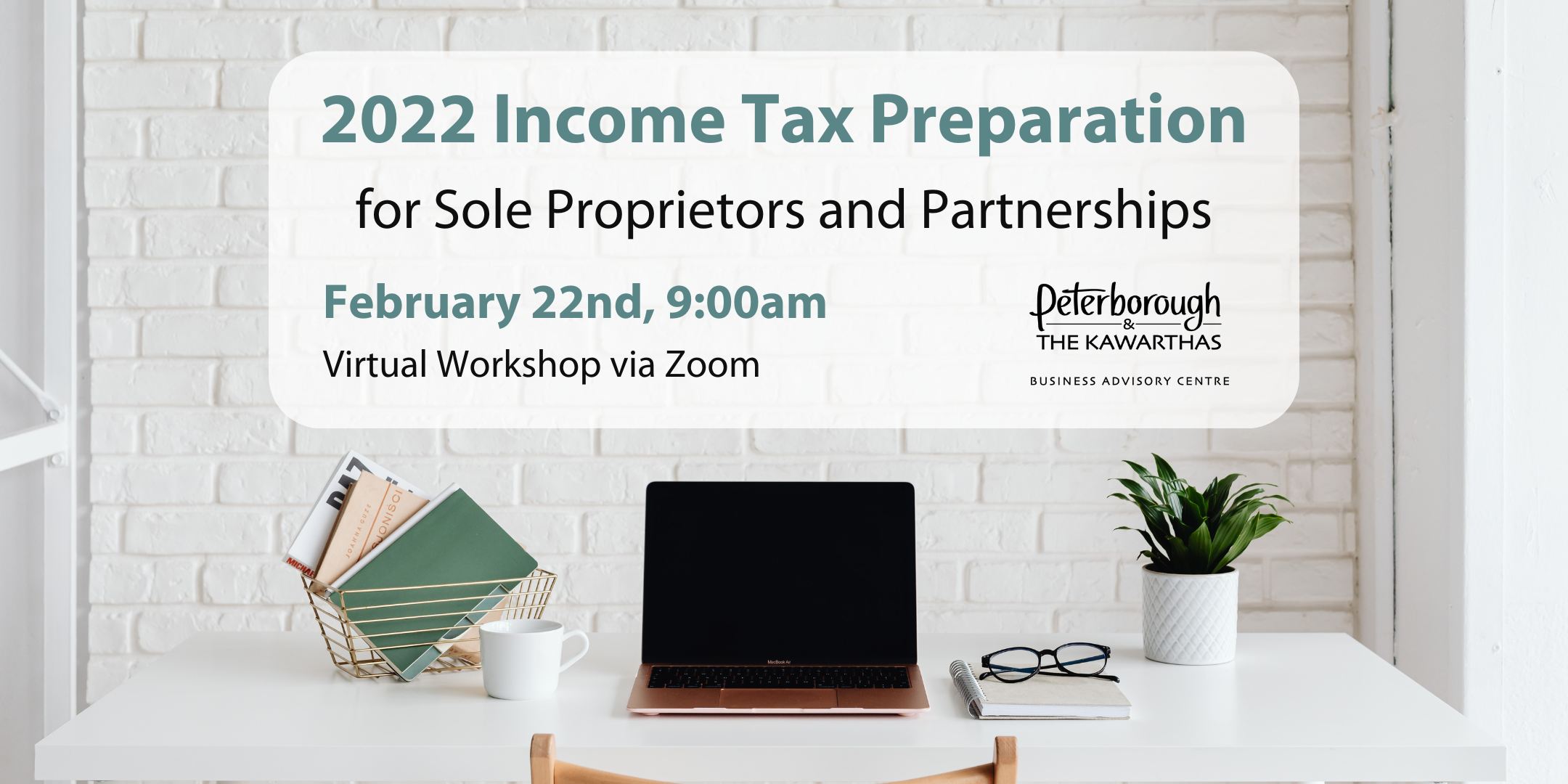

February 22, 2023 @ 9:00 am - 10:30 am EST

2022 Income Tax Preparation for Sole Proprietors and Partnerships

Event Category:

This 90-minute webinar is a perfect standalone session or as an addition to the Canada Revenue Agency (CRA) Informational Seminar for Small Business.

Instructor will lead participants through the process of completing their 2022 Income Tax Return using form T2125 to report self-employed business income and expenses.

In this webinar we will cover:

- Setting Up a My Business Account with CRA

- Submitting HST and Payroll Remittances Online

- Filing Your 2022 Self-employment Income Tax Requirements

- Completing the Statement of Business or Professional Activities T2125 (copy attached) for 2022 Income Tax Filing

- Part 1 – Identification

- Part 2 – Internet Business Activities

- Part 3 – Business & Professional Income

- Part 3C – Claiming Grants

- Part 3D – Cost of Goods Sold & Gross Profit

- Part 4 – Net Income Before Adjustments

- Part 5 – Your Net Income

- Part 6 – Other Amounts Deductible From Your Share of Net Partnership

- Part 7 – Calculating Business-Use-of-Home Expenses

- Part 8 – Details of Other Partners

- Calculation of Capital Cost Allowance (CCA)

- Claiming Motor Vehicle Expenses

- Common Income Tax Errors Made by Small Business

- Financial Performance Benchmarks

Resources:

- Self-Employed Tax Preparation Checklist

- Self-employed Business, Professional, Commission, Farming, and Fishing Income Guide T4002

- Statement of Business or Professional Activities T2125

- Statement of Farming Activities T2042 (if applicable)

- Statement of Fishing Activities T2121 (if applicable)

- FREE CRA Approved Online Income Tax Filing Software

Click here to learn more or register below.